With the start of the year, several asset managers and investment firms are beginning to publish their outlooks for the year ahead for both the equity and fixed-income markets.

For investors and financial advisors, these outlooks can serve as a blueprint for asset allocation decisions, sector rotation, and additional investment. For municipal bond investors, that means paying attention to what asset managers like Nuveen have to say.

The firm was one of the first to begin underwriting municipal bonds before 1900 and has since grown into one of the world’s largest municipal debt managers. As such, its bench strength within the sector is impressive. So, when the firm talks about munis, investors should listen. With that, a new paper by the group highlights what investors should expect this year.

A Positive 2024

After a tumultuous few years, the sleepy municipal bond sector returned to its “boring” nature. Driven by strong demand, short supplies, and robust taxable-equivalent yields, munis performed well in 2024.

Looking at data provided by Morningstar, we see that the broader municipal bond market and various subsectors managed to provide positive total returns. National investment-grade intermediate muni bonds — which are the benchmark of the sector — managed to give a total return of 1.89%. Long bonds yielded a return of 2.35%, while investment-grade short term munis offered a mix of gains and interest of 2.54%. Those investors looking to the high-yield market saw a strong 4.95% total return.

Overall, those are good total returns for the sector. Nonetheless, they have come with some volatility. The last quarter of the year experienced significant price drops for a variety of municipal bond sectors as the Federal Reserve (Fed) started to slow the pace of rate cuts, inflation increased, and political uncertainty began to affect the markets.

What’s ahead for the municipal bond sector? Will investors see similar results, and where should they focus their attention to achieve the best return? Asset manager Nuveen may have the answer. In their recent whitepaper, Nuveen outlines five key takeaways and themes for the 2025 municipal market.

1. Monetary to Fiscal Policy Shifts

For starters, current monetary policy concerns will give way to fiscal policies. And that could provide a backdrop for additional municipal bond gains. According to Nuveen, the Fed has done a good job of fighting inflation and has largely gotten it under control. While CPI and other inflationary metrics have begun to tick up in recent readings, they are still well below the 1980s-style numbers seen just a few years ago. With that, the Fed’s rate cuts have started to matter less.

What will drive munis is the rising need for fiscal and tax policies. Nuveen expects several key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) to be extended under President Trump. However, as potentially positive as these tax cuts are, they can lead to higher taxes later on. This provides a backdrop for municipal bond ownership.

2. Low Valuations vs. Other Investment-Grade Bonds

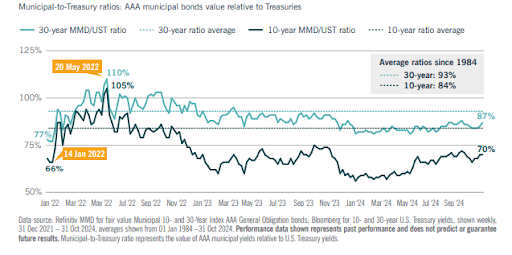

With rising fiscal policy concerns, municipal bonds currently have an advantage. Yields and valuations are still at very compelling levels. The recent pullback in muni bond prices has only enhanced that fact further. Looking at historical data, the 10-year municipal-to-treasury ratio has been 84%. According to Nuveen, a shift over the last five years has allowed ratios to move lower, with sub-70% ratios the new norm. This provides a compelling valuation and spread between Treasuries and municipal bonds. This chart from Nuveen summarizes their findings and highlights discounts for both 10-year and 30-year maturities.

Source: Nuveen

3. High Municipal Bond Supplies

After diminished supplies in 2022 and 2023, last year saw a return of many issuers to the muni market. According to Nuveen, muni issuance through October 2024 was 43% higher than last year at $436 billion. While higher supply may be counterintuitive at first glance, it could be good for muni investors.

That’s because yields are already high. Higher supplies of munis may keep a lid on prices but will allow investors to enjoy a much greater yield or cash return. That’s key because it sets munis back on course to be a low-volatility asset class. Moreover, it makes them more attractive compared to other bonds such as investment-grade corporates, which have also seen supplies rise over the last year. Currently, munis offer high yields and high taxable equivalent yields, providing a better cash return than other taxable bond types.

4. Rising Muni Demand

The best part is that the increasing supplies have been met with strong and growing demand, keeping the market in balance. According to Nuveen, the municipal market still has room to recover. Last year, strong inflows in muni funds and ETFs of $28.7 billion were seen. That’s been great for matching current supplies. However, it doesn’t come close to the $170 billion outflows that 2022 and 2023 saw. There’s still more demand potential.

Nuveen suspects that demand will come back toward the end of 2025 and into 2026 as returns on cash and cash-like asset classes will prompt many investors — specifically high-net-worth investors — to return to the muni market. This will help soak up additional supplies and boost overall demand.

For investors today, this is a great time to lock in yields (thanks to high supplies/low valuations).

5. Improving Credit Quality

Finally, Nuveen highlights the credit quality of municipal issuers. Despite some recent hiccups, many states and local governments are still flush with cash. Rainy day funds are strong, while proactive budget cuts have begun to work their magic. As a result, Moody’s data show the number of credit rating upgrades has continued to outpace downgrades by a 3-to-1 margin through the start of the year.

Focusing on Munis

With these strong tailwinds in tow, Nuveen expects that 2025 could be another great year for municipal bonds and their investors. The sector’s strong current yields, coupled with some potential demand drivers, will help generate a strong total return compared to other fixed-income types.

On that note, overweighting munis or adding an allocation makes a ton of sense. However, like many fixed-income sectors outside of treasuries, buying individual munis may be a tough nut to crack. To that end, betting on various ETFs and funds makes sense. Active management could play a significant role in boosting the performance of a muni bond portfolio.

Active Municipal Bond ETFs

These ETFs were selected based on their ability to provide low-cost and active exposure to the municipal bond market. They are sorted by their 1-year total return, which ranges from 1.9% to 9.1%. They have expense ratios between 0.07% and 0.65% and assets under management of $240M to $3B. They are currently yielding between 2.9% and 5%.

| Ticker | Name | AUM | 1-Year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYMU | iShares High Yield Muni Income Active ETF | $244M | 9.1% | 4.4% | 0.35% | ETF | Yes |

| NEAR | iShares Short Duration Bond Active ETF | $2.96B | 5.1% | 5% | 0.25% | ETF | Yes |

| CGMU | Capital Group Municipal Income ETF | $2.59B | 3.3% | 4.2% | 0.27% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $630M | 3% | 2.9% | 0.35% | ETF | Yes |

| VTES | Vanguard Short-Term Tax Exempt Bond ETF | $561M | 2.4% | 2.9% | 0.07% | ETF | Yes |

| FMB | First Trust Managed Municipal ETF | $2.04B | 2.3% | 3.3% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.75B | 2.3% | 3.3% | 0.35% | ETF | Yes |

| DFNM | Dimensional National Municipal Bond ETF | $1.42B | 1.9% | 5.2% | 0.19% | ETF | Yes |

Passive Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their one-year total return, which ranges from 1.8% to 6.5%. They have expense ratios between 0.05% and 0.35% and assets under management between $2.8B and $42B. They currently offer yields between 2.4% and 4.4%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYMB | SPDR Nuveen Bloomberg High Yield Municipal Bond ETF | $2.86B | 6.5% | 4.4% | 0.35% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $39B | 2.1% | 3.2% | 0.05% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.65B | 1.9% | 2.4% | 0.20% | ETF | No |

| MUB | iShares National Muni Bond ETF | $41.1B | 1.8% | 3.1% | 0.05% | ETF | No |

All in all, Nuveen’s thought process highlights why municipal bonds should be a part of your fixed income allocation this year. Demand and high yields will ultimately benefit investors and lead to positive total returns.

Bottom Line

Municipal bonds had a good 2024, providing strong total returns. According to Nuveen, the new year also promises to be strong. Low valuations, high yields, and changes to tax policies all bode well for the sector and investors going forward.