A new year brings new opportunities. It also brings plenty of uncertainty to the table. From geopolitical woes and recession potential to new taxation and macroeconomic headwinds, there’s a lot to digest these days. This is true for the humble and often boring municipal bond market. Muni investors have a lot on their plates this year.

This is why they may want to stay nimble.

Active management could play a huge role in the returns of municipal bonds this year with indexes falling flat. Uncertainty and volatility about a host of muni-specific factors are now growing. And that requires a deft touch. Luckily, munis happen to be one of the best sectors for active to win out.

A Mixed Bag in 2024

For many municipal bond investors, 2024 is a year they’d like to forget. Returns for the fixed income asset classes weren’t bad per se, with intermediate-term munis returning a positive nearly 1.9% for the year. However, those returns were far below the exceptions. If you remember, last year was supposed to be the year that inflation was whipped and the Federal Reserve (Fed) was going to cut rates by a substantial amount.

However, with inflation still running a bit hotter than the Fed would like, those rate cuts have been less than predicted. That’s thrown a lot of uncertainty into the mix about the municipal bond sector.

And now, other concerns have crept into the mix. The incoming Trump Administration has pledged some wide-sweeping changes to tariffs, taxes, and other policy points. That uncertainty and volatility has caused yields on Treasury bonds to move higher, despite the Fed cutting rates.

For muni bond investors, this has created a series of crosswinds.

Growing Volatility Amid Some Positives

The issue is that none of these concerns are going to go away any time soon. Many municipal bond analysts—from Goldman Sachs to BlackRock—now predict that volatility in the muni market may be here to stay.

For starters, the threat of munis losing their tax-exempt status is still on the table. As the Tax Cuts & Jobs Act sunsets this year, many lawmakers are looking to expand portions of the bill. However, to make up for many of the tax cuts, tax increases elsewhere might need to be proposed. That has muni’s tax-exempt status now in question. This has thrown plenty of extra volatility onto the sector. While many analysts predict that the exemption won’t be actually challenged, there’s still a potential.

Meanwhile, the Trump Administration’s plans to launch tariffs, reorganize the Federal government, and throw a wrench into geopolitics are adding additional woes to the economy, inflation projections, and consumer trends.

This has come on the back of rising municipal bond supplies.

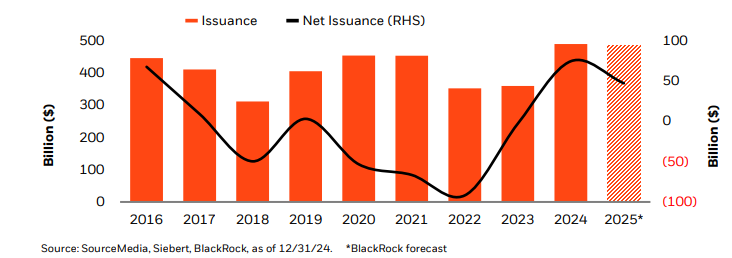

States and local governments have started to seriously issue muni bonds once again now that interest rates have declined from their highs and the Fed has begun pausing/settling in. For example, both California and Texas had numerous bond proposals on the ballot this past November that passed. With that in mind, major municipal bond underwriters now predict that 2025 will see about $500 billion in new bonds launch on par with 2024. This chart from BlackRock highlights the issuance growth over the last few years.

Source: BlackRock

These headwinds have been met head-on via some strong tailwinds for the municipal bond sector.

The interesting piece of the BlackRock chart happens to be that black line. This represents net issuance. The bulk of new muni supply this year is actually covering refinancing and reissues. With that, only $47 billion worth of new munis are hitting the market. That changes the supply/demand dynamic a bit. Moreover, many analysts point to the fact that munis are still providing high yields. With more than $7 trillion in cash now yielding less because of the Fed’s rate cuts, analysts predict that supplies of munis will be sopped up by retail and institutional investors.

At the same time, the issuers of munis—states and local governments—have only strengthened their finances over the last year. Many states have turned to increasing sales taxes to limit any weakness in personal income or property taxes. At the same time, many states have been proactive in budget cuts to save money. With that, rainy day funds are still 14.4% of the states’ general budgets.

So, 2025 is shaping up to be a mixed bag for muni investors. The yield of bonds could be the real factor in determining actual gains.

Active Management Could Be the Key

The question for investors is: How do they navigate the current muni environment for strong returns in 2025? The answer from a surprisingly wide swath of analysis remains nimble. The higher volatility of the upcoming year is no place for index investors; they’ll get whipped around by all the shifts and volatility.

To this end, active management could be the key to success.

Active managers can over- or underweight portions of the market as they see fit or dive headfirst into these other opportunities. This can provide extra returns. In this case, it does. A study by Morgan Stanley showed that active beats passive over 84 different rolling three-, five-, and 10-year periods with the extra active return clocking in at 68 bps, 53 bps, and 33 bps, respectively, for the periods. These results have been echoed by a host of different studies.

This is important as many of the strategies to overcome much of the muni sector’s volatility—such as barbelling, focusing on credit, and looking to yield to drive returns- —are often lost in an index fund. For example, many municipal bond indexes exclude housing bonds, tobacco bonds, and bonds that are subject to the alternative minimum tax (AMT).

That’s not so with active managers. As such, a resounding chorus of analysts point to the fact this could be the best environment in years for active managers to shine in the municipal bond sector.

The best part is getting that active exposure is very easy. The number of active municipal bond ETFs continues to grow, while SMAs, mutual funds, and closed-end funds have long been wonderful vehicles to get activement management in the sector.

Active Municipal Bond ETFs

These ETFs were selected based on their ability to provide low-cost and active exposure to the municipal bond market. They are sorted by their one-year total return, which ranges from 2.2% to 8.6%. They have expense ratios between 0.19% and 0.65% and assets under management of $240M to $3B. They are currently yielding between 1.1% and 6.8%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYMU | iShares High Yield Muni Income Active ETF | $244M | 8.6% | 4.4% | 0.35% | ETF | Yes |

| NEAR | iShares Short Duration Bond Active ETF | $2.96B | 5.2% | 6.8% | 0.25% | ETF | Yes |

| CGMU | Capital Group Municipal Income ETF | $2.59B | 3.7% | 4.18% | 0.27% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $630M | 3.1% | 2.9% | 0.35% | ETF | Yes |

| FMB | First Trust Managed Municipal ETF | $2.04B | 2.7% | 3.3% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.75B | 2.5% | 3.2% | 0.35% | ETF | Yes |

| DFNM | Dimensional National Municipal Bond ETF | $1.42B | 2.2% | 1.1% | 0.19% | ETF | Yes |

Overall, volatility is coming to the muni sector with a vengeance. There are plenty of positives and negatives. This has only driven uncertainty and the need to be nimble. Investors looking to add munis and their strong positives should look toward active means to invest within the sector.

The Bottom Line

Heading into 2025, volatility and uncertainty is creating rough seas for the boring and staid municipal bond sector. Those seas require a strong navigator. That means a hefty dose of active management is in order to generate positive returns.